When it finds it with a Website, it takes advantage of the Interledger protocol to stream dollars in analogy to the best way that Netflix streams video.,600 (about $3).

Samsung Spend can be used greatly in Korea since it doesn? t need NFC terminals to work and so Korean establishments didn? t bother to setup them. Korea is residence to Samsung and its payment options are broadly integrated to the Korean payments system. taps with a mobile cellular phone and, bam, some seconds later on the money lands in the receiver? s account? have speedily turned these and also other peer-to-peer (P2P) payment apps into day to day equipment for millions of usa citizens.|Standalone payment services have quite a few drawbacks. They have to be applied on the web site, which leaves information creators and publishers going through the Market paradox: no person will apply it if not a soul is employing it, but nobody will utilize it if nobody is applying it, which might go away publishers within a ??chicken|rooster|hen} and egg??problem.|Including micropayments to an by now sophisticated electronic Area won't provide only Gains, it will carry important problems also.|Many of the fears elevated by CR? s analysis must do with challenges in excess of which consumers have minor control past selecting not to make use of the applications? and as P2P app utilization grows, opting out is starting to become significantly challenging For lots of People in america. As a substitute, these problems will must be resolved either by the P2P organizations themselves or by policy makers. In the meantime, Here's steps you will take to attenuate the threats of using P2P payment apps. Affirm the id of a recipient before you decide to send funds. Remember the previous carpenter? s expressing, ??Measure|Evaluate} 2 times, Reduce when???The P2P equal is double-examining the receiver? s telephone number and/or electronic mail handle prior to hitting deliver.|How do these cards Allow you to pay out in Korea? The method is basically basic. 1st, make an application for the card before you vacation and down load the appropriate app that goes with it. Transfer funds from your lender to top-up the cardboard harmony in your home forex and afterwards change that into Korean won (or other currencies you could need). After you get there in Korea, use the card as you'd probably a regular bank card. My encounter using Intelligent in Korea: I? ve examined out equally the Wise card and Revolut card in Korea they usually the two worked without real complications.|These micropayments are utilised to purchase added attributes throughout the recreation. These features are commonly optional, however the willingness of avid gamers to purchase them results in a substantial ongoing earnings stream for your publisher of the sport and experienced resulted in a condition exactly where absolutely free-to-play online games deliver a lot more profits than their paid-for counterparts.|Micropayments facilitate modest transactions that catch the attention of company and enhance earnings. Retailers can make use of micropayments in a variety of sorts like reward cards, subscription billing, and retailer credit rating. This provides prospects through the door and back at a later on date. As Formerly outlined, merchants can empower micropayments within their payment processing to easily give unique goods to their shoppers in a low cost.|Learn more: I? ve created about Korean transportation cards a good deal because they? re genuinely valuable for travellers coming to Korea. Two of my favourites are the Korea Tour Card, that is a tourist-only transportation card, as well as the T-Funds Card, which can be the most well-liked transportation card used in Korea.|It? s beginning to occur ??the chances are increasing that you choose to? re missing profits in this article and now from website visitors that may use micropayments if you supported them|With the globe? s most significant digital platforms counting 소액결제 현금화 their active users in the billions, it certainly appears to be that a possible important mass exists.|What Trade price does Apple Spend use? Apple? s Trade amount is regardless of what fee the credit card issuer is applying. The exact same applies to Samsung Spend. The Intelligent multi-currency card, in comparison, uses the mid-sector fee, which could give you a superior charge when you shell out in Korea.|Nevertheless, the fundamental enterprise practices of engagement, facts and targeting are getting to be ever more harmful for all included ??to the point at which democracy alone looks in danger|Meanwhile, most contributor information ends up on social networking sites that don? t pay nearly anything towards the contributors whose information generates their ad income. And still the sheer convenience of ??one|1|a single|one particular|just one|a person} click on??authentication ensures that the net is ever more dominated by centralised giants, the likes of Fb, Amazon, Google, and Apple.|Subscribe to our newsletter for guidelines, inspiration and Perception about WordPress and WooCommerce and the digital entire world further than.|In accordance with A different recent CR survey, this a single a nationally consultant study of 2,123 U.S. adults in August 2022, 65 % of usa citizens say They can be relatively or pretty concerned about simply how much facts monetary apps accumulate and retail outlet about their consumers. About 50 % believe that economic apps shouldn't be allowed to share consumer info with other firms. CR? s Examination confirms a large number of P2P buyers have rationale to be anxious. Details selection: Besides collecting information regarding someone? s action when using the P2P service? payment amounts, dates, recipients? the applications we checked out Assemble large quantities of private knowledge they do not require in order to provide their Main service. This tends to include things like knowledge out of your mobile gadget, such as contacts, specifics of your other World wide web activity, and even the digitized history of the fingerprint that your cellular phone works by using for safety.|A key difficulty for information publishers is to determine whether or not customers prefer for every-use or recurring payment selections. The broader pattern in electronic is from specific transaction to recurring subscription.|Scientists are considering new techniques for optimizing the capabilities of payment channel networks (PCNs). Many of such remedies have not been carried out in actual-world networks but display promising early outcomes.}

Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Christina Ricci Then & Now!

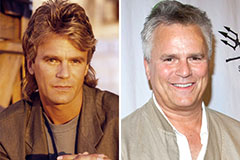

Christina Ricci Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!